Question: When is a tax return not a tax return?

Answer: When it is filed late and you have filed for or are thinking about filing for bankruptcy.

Chapter 7 Bankruptcy and Income Tax Debt

Why is this information important to someone who is filing for bankruptcy?

Folks filing for bankruptcy who turn to Chapter 7 of the bankruptcy laws, seek to have all of their debts forgiven without paying all of the obligations off. Current tax liabilities are an exception to the rule, but past years (three years and older) tax return liability will be discharged if all of the following conditions are met.

- No tax lien has been filed against you against your home and other assets. If a lien has been filed, it survives the bankruptcy. This means that the Federal can still seize your property in order to collect tax debts even if they have been discharged.

- The tax returns you files were accurate and not fraudulent and you did not attempt to evade paying your tax obligation

- The tax liabilities are more than three years old

- Any tax deficiencies were filed against you for prior returns were assessed no less than 240 days before your bankruptcy filing.

This means that if you have put off filing tax returns because you owed money and could not pay, were simply afraid to file because you already had been assessed for an earlier year or whatever other reason or excuse you have, not filing means that those tax liabilities will still be owed. According to the Internal Revenue Service, for the purpose of bankruptcy, a late return filed as you contemplate or file for bankruptcy is not a tax return.

In fact, when the bankruptcy laws were modified by congress in 2005 they changed amended the language regarding tax return to include any kind of notice to the Internal Revenue Service concerning a tax return.

Most law authorities will not argue that a tax return is ample notice of tax due. But, say you did not file a return but sent a letter to the IRS saying that you for the year ending (YE) 2008 you owed the government $2,000 – under the modified language that would be acceptable and allow you to discharge the debt. However, legal experts advise that you always you the appropriate Internal Revenue Service Form rather than a- living your notice of taxes due.

Filing a Chapter 13 Bankruptcy and Income Tax Debt

If you filed or are going to file a Chapter 13 bankruptcy then the Internal Revenue Service will be paid as part of the repayment plan approved by the bankruptcy court. However, if you fail to pay current taxes on time the repayment plan could be thrown out and your tax debt subject to aggressive IRS collection procedures.

Other Reasons To File Taxes on Time

As part of your bankruptcy proceedings, either Chapter 7 or Chapter 13, the court and your attorney will want to see your current tax return to understand your financial condition. If you have not filed them on time, you have to calculate them or hire a tax preparer. This only delays your bankruptcy and is a jarring pothole on the road to your new financial life.

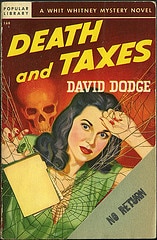

Photo by numberstumper