We are one of the few firms in New York that deals with Tax Debt through Bankruptcy Court filings and are in daily contact with the IRS, NYS, the United Stated Attorneys and Attorney Generals on tax matters. We also have regular contact with IRS Special Procedures agents in Brooklyn, Asst. Attorney Generals in NYC, IRS local counsel in NYC, NYS Counsel in NYC, Long Island and in Albany, NY. Furthermore, we deal with the Department of Justice in Washington, D.C., especially when the tax debt in New York exceeds $1M. We offer Bankruptcy/Tax Discharges services in New York.

We are New York Tax Attorneys and one of the few firms that deal with Sales Tax problems in NYC and Corporate Trust Fund issues in NY. With Tax Attorneys in New York, Brooklyn and Long Island, we deal with income tax debt and tax discharges in the New York tri-state area as well as Long Island and Westchester.

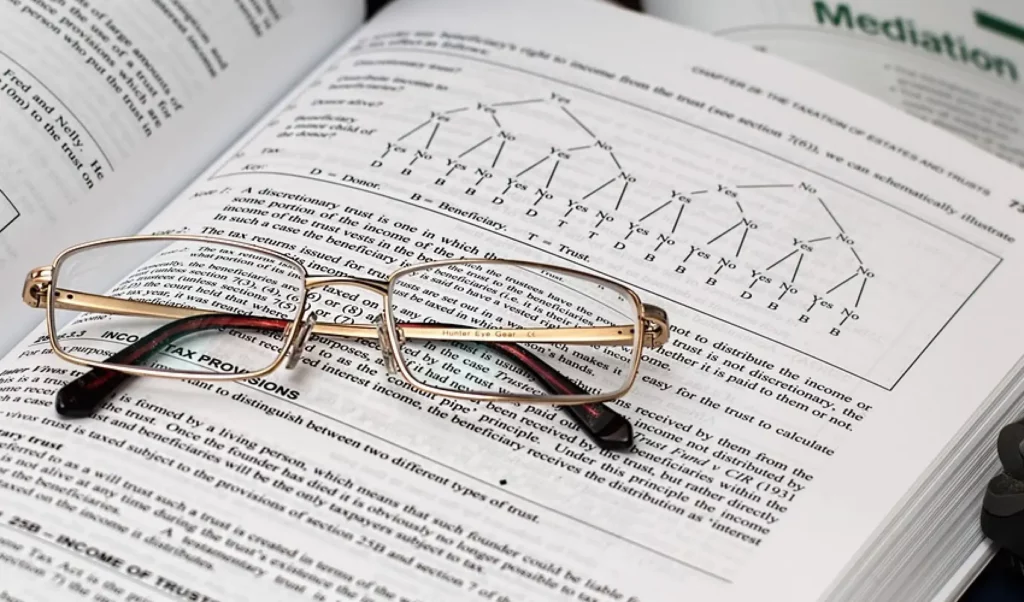

All of our attorneys are admitted in New York and are members of New York District Courts and the Tax Court. We have authored articles on taxation and bankruptcy and have lectured on these subjects to other attorneys and accountants. We have attorneys admitted to the Supreme Court holding an LLM in Taxation and also a CPA.