At the Law Offices of Stephen B. Kass, we specialize in providing comprehensive legal solutions for both tax and bankruptcy issues. With decades of experience, Stephen B. Kass has established himself as a leading tax attorney in New York City, offering expert advice and representation to individuals and businesses facing financial difficulties and tax-related challenges.

Personalized Legal Assistance

Understanding that each client has unique needs, our firm tailors its services to provide the most effective solutions specific to your legal situation. Whether you’re dealing with the IRS, or facing tax liens, Stephen B. Kass provides personalized legal guidance to navigate these complex issues.

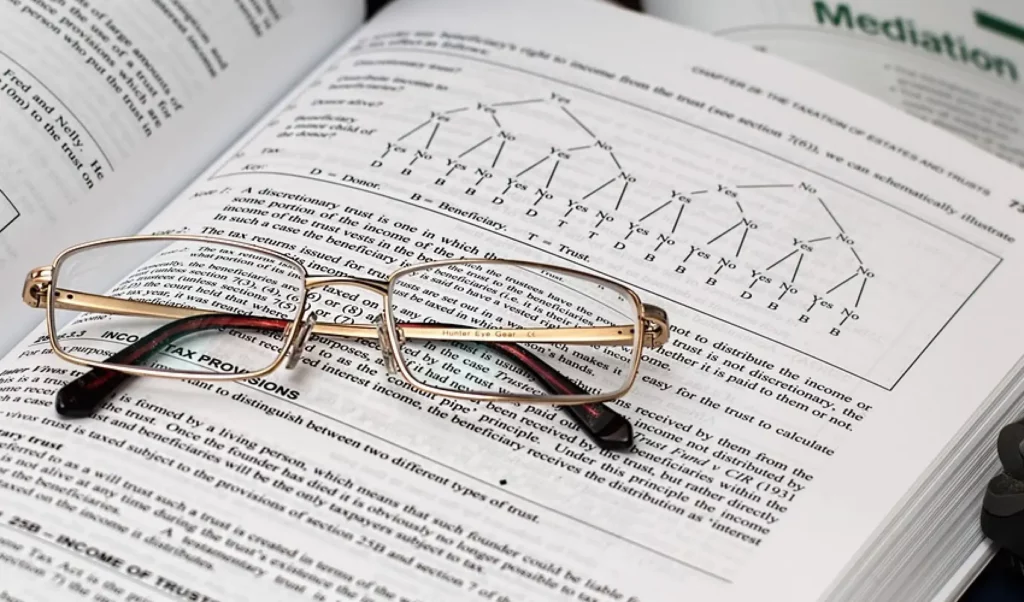

NY Tax Attorney – Services Offered

IRS Negotiation and Settlement: We negotiate with the IRS to reduce your tax liabilities through offers in compromise, installment agreements, and penalty abatement.

Tax Dispute Resolution: Handling audits, appeals, and litigation related to federal and state taxes.

Business Tax Services: Assistance with payroll tax issues, business tax planning, and resolving business tax debts.

Why Choose Us As Your NY Tax Attorney?

Expertise and Experience: Decades of focused practice in tax law.

Client-Centric Approach: Every case is handled with a commitment to personal attention and tailored strategies.

Proven Track Record: NY tax attorney with a history of successful outcomes for clients facing complex tax and financial issues.

Schedule a Consultation

If you’re looking for a New York City tax attorney, contact the Law Offices of Stephen B. Kass today. Schedule a consultation to discuss how we can assist with your tax needs and help you achieve a more secure financial future.

Contact us today to learn more about our services and how we can assist you in navigating the complexities of tax law.