Comprehensive Guide to Subchapter V in Chapter 11 Bankruptcy

Understanding the benefits and complexities of Subchapter V in Chapter 11 Bankruptcy is essential for small businesses facing financial challenges. This latest addition to the bankruptcy code offers a streamlined and cost-effective solution for small business debtors to reorganize and resolve their financial issues. In this comprehensive blog post, we’ll delve into the advantages of […]

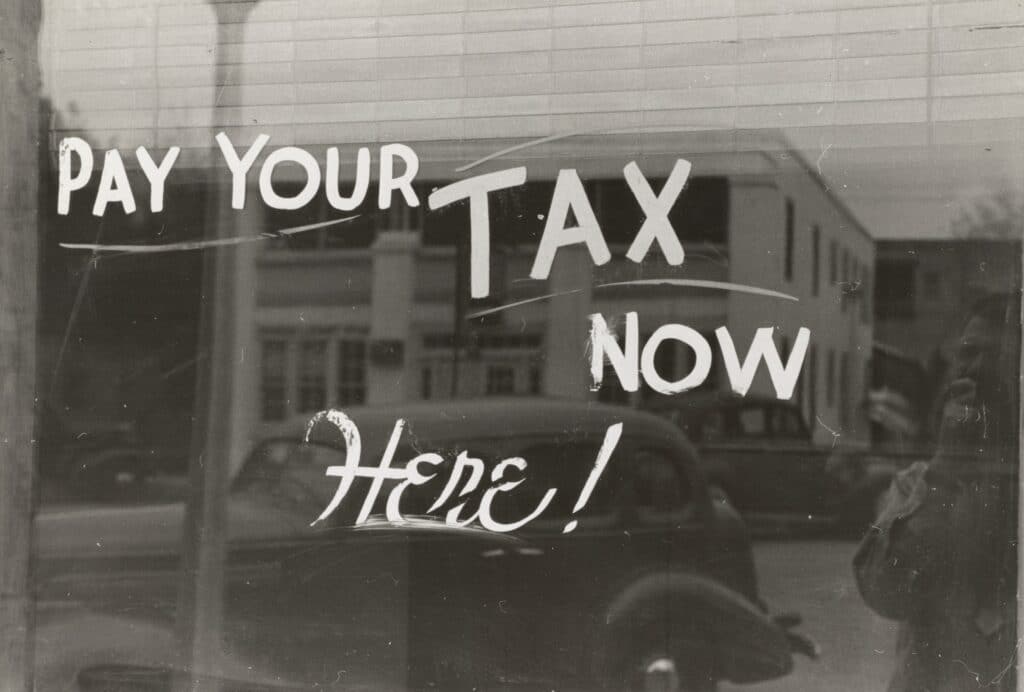

Tax Penalty Abatement Explained: Reducing Your IRS Debt

Financial challenges can be a source of stress and uncertainty for any business owner, especially when it comes to resolving tax issues with the Internal Revenue Service (IRS). Developing an effective tax resolution plan tailored to a business’ unique situation is crucial for reducing debt and ensuring future compliance. In this informative blog post, we’ll […]

Understanding IRS Tax Liens and How to Overcome Them

Dealing with IRS tax liens can be a confusing and challenging experience for business owners. Understanding the consequences of tax liens, your options for resolution, and the importance of seeking professional guidance is crucial for navigating this complex situation and protecting your business’ financial health. In this comprehensive post, we’ll explore what a tax lien […]

Navigating IRS Audits: A Comprehensive Guide for Business Owners

Facing an IRS audit can be a daunting and nerve-wracking experience for any business owner. Understanding the audit process, knowing your rights, and being prepared are crucial for ensuring a favorable outcome and maintaining the financial health of your business. In this comprehensive guide, we’ll explore the different types of IRS audits, how to navigate […]

Don’t Panic: Understanding IRS CP501 Notice

Nobody likes to receive a notice from the IRS, but it’s important not to panic. One of the most common notices is the CP501, sent when you have unpaid taxes. Fortunately, this article will discuss what the CP501 notice means and what steps you should take with your tax attorney if you receive one. What […]